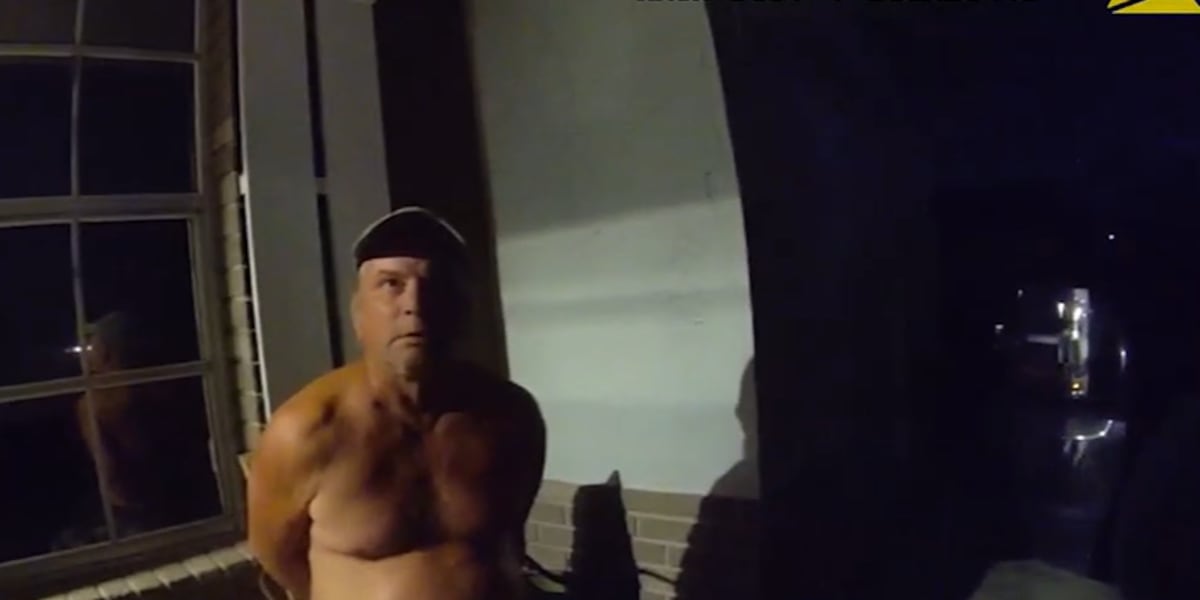

Jeffrey Moynihan, 56, was arrested in Bradenton, Florida, for grand theft after allegedly defrauding a 74-year-old Texas woman of $600,000. Posing as Elon Musk on Facebook, Moynihan convinced the victim to invest in fraudulent businesses, promising a substantial return. The victim, fearing financial insecurity, sent Moynihan the money over several months. This case highlights the concerning rise in elder fraud, with Bradenton Police reporting nearly $3 million in losses from such crimes this year alone.

Read the original article here

A man successfully impersonated Elon Musk, defrauding a woman of a staggering $600,000, according to the Bradenton Police Department. The sheer audacity of the scheme is almost comical, yet the devastating financial consequences for the victim are undeniably serious. The supposed scenario, involving a plea for money from a supposedly imprisoned Musk to bribe Nigerian guards, highlights a disturbing vulnerability to elaborate scams. It makes you wonder how someone could fall for such a blatant ruse.

The incident raises immediate questions about the victim’s judgment. Handing over $600,000 to someone claiming to be the world’s richest man, even under duress, seems incredibly improbable. It underscores a critical issue: the susceptibility of some individuals to scams, regardless of their wealth. Perhaps this points to a lack of financial literacy or an overreliance on emotion rather than logic in such high-stakes situations.

The Bradenton Police Department’s Elder Fraud Unit is clearly busy. Their reported investigations totaling nearly $3 million in losses this year in a city of only 57,000 people paints a worrying picture of widespread elder fraud. Extrapolating these figures nationally suggests a truly alarming level of financial exploitation across the United States – potentially in the tens of billions of dollars annually. It begs the question: What systemic failures allow such rampant fraud to persist?

This case also touches on broader societal issues. Some commentators suggest the victim’s actions are a reflection of excessive greed, a willingness to chase high returns without considering the risks. Others point to a lack of financial security among older citizens, forcing them to take risky chances in the hope of improving their financial situations. And, there’s the underlying reality of age-related vulnerabilities that fraudsters expertly exploit.

Beyond the immediate specifics of this case, there’s a growing concern about the prevalence of elaborate scams that prey on people’s trust and desperation. This incident is only one example of the many creative and brazen attempts by scammers to take advantage of their victims. It showcases the need for increased public awareness and education on the tactics used in these schemes. Better fraud detection mechanisms and harsher penalties for perpetrators are also essential.

Adding another layer of complexity is the ironic juxtaposition with the actual Elon Musk. There are accusations against the real Musk himself regarding alleged financial misconduct, including accusations of defrauding the US government of billions in subsidies. This unfortunate parallelism raises questions about the ethics of success and the lines frequently blurred between legitimate business practices and outright fraud. The parallels, intentional or not, are striking and rather darkly humorous.

The fact that the impersonator seemingly managed to mimic Musk’s physical appearance, down to his hairline, only exacerbates the effectiveness of the deception. This level of detail illustrates the lengths scammers will go to in order to build trust and manipulate their targets. It highlights the sophistication of modern scams and how they leverage easily accessible information to their advantage.

While the case of the $600,000 fraud is undoubtedly shocking, it also serves as a stark reminder. It’s a reminder to remain vigilant against scams and to exercise caution when making financial decisions, particularly involving unsolicited contact from individuals claiming to be prominent figures. The incident underlines the importance of critical thinking, verification of information, and, perhaps most importantly, trusting your gut instincts when something feels too good to be true. It’s also a cautionary tale about the vulnerability of those who are targeted by such scams, whatever their financial circumstances. Ultimately, it’s a complex issue that requires multifaceted solutions to address its underlying causes.