Stay informed on the 2024 US Presidential election with the FT’s comprehensive coverage, including news, analysis, and data. Access exclusive insights and policy plans through the White House Watch newsletter. Gain deeper perspectives on the election’s impact on democracy through the Democracy 2024 section. These resources offer a complete understanding of the election and its implications.

Read the original article here

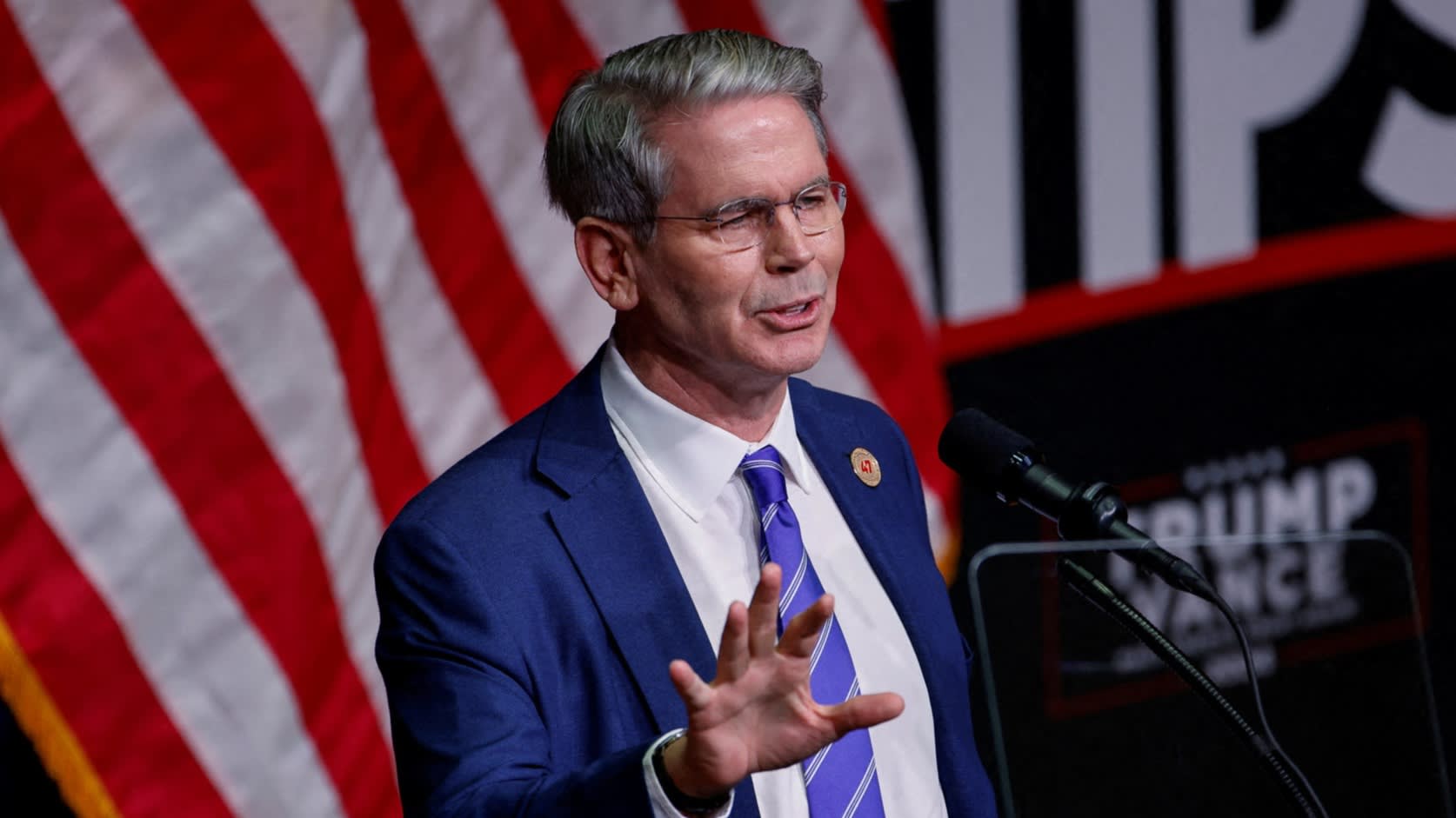

The dollar’s recent dip following Donald Trump’s appointment of Scott Bessent to a Treasury role has sparked considerable debate. This isn’t simply a matter of fluctuating currency values; it reflects a deeper unease about the potential economic trajectory under a Trump administration.

The appointment itself has raised eyebrows. Bessent’s background, including his association with George Soros, directly contradicts the anti-Soros rhetoric often heard from within the conservative camp. This incongruity has many questioning the consistency and even the credibility of the Trump administration’s economic pronouncements.

The weakening dollar signals a lack of confidence among global investors in the Trump administration’s economic management. The concern isn’t merely about the administration’s competency, but also about its willingness to address the nation’s debt. A weaker dollar invariably translates into higher prices for consumers, impacting the average American’s purchasing power.

Further fueling these concerns are Trump’s past statements and policies. His suggestions of pulling out of NATO, coupled with a potential shift in US foreign policy toward China and Taiwan, cast doubt on the long-term stability of the dollar’s role as the world’s reserve currency. A retreat from global engagement could significantly undermine the US economy and thus the value of its currency.

The potential consequences extend beyond the immediate devaluation. Reduced living standards, particularly for lower and middle-income families, are a real possibility. The overall economic impact could be dramatic; some analysts predict a substantial decrease in the living standards of a large portion of the population. This potential decline is a direct result of policies perceived as poorly conceived and potentially detrimental to the long-term economic health of the nation.

This economic uncertainty is further exacerbated by Trump’s past business dealings. His history of bankruptcies casts a shadow over his ability to manage the nation’s finances responsibly. This skepticism extends to his choice of personnel. The perception is that the appointments reflect a prioritization of personal connections and loyalty over proven economic expertise. A pattern of appointing individuals with questionable qualifications and potential conflicts of interest only strengthens this concern.

Interestingly, while some headlines might point to a dramatic fall in the dollar’s value, a more nuanced view reveals a more complex picture. The dollar’s movement is influenced by multiple factors, and its value isn’t solely dictated by a single appointment. Yet, the drop, however slight, adds to the existing anxieties.

The drop in the dollar is seen as a consequence of the broader concerns regarding economic policy under the Trump administration. Investors are reacting to the perceived risk associated with his economic plans, leading to reduced confidence and the subsequent devaluation of the dollar.

Furthermore, independent analysts are linking the decline in the dollar to the recent movement in US bond yields. These declining yields suggest a growing apprehension about the long-term economic stability under the current administration. The belief is that lower yields decrease the appeal of US dollars as an investment, leading to their devaluation.

This situation presents a complex challenge. It highlights the interconnectedness of global finance and the profound impact of political decisions on economic stability. The fall in the dollar’s value after the Bessent appointment is not an isolated event; rather, it’s a symptom of a wider concern about the uncertain economic future under the current administration. This uncertainty is only amplified by Trump’s past actions and his apparent disregard for expert advice on economic issues.

It remains to be seen how the situation will unfold. However, the initial reaction from the financial markets clearly indicates significant apprehension regarding the economic policies and choices of the Trump administration. The coming months will be crucial in determining whether this apprehension is justified, and if so, the degree to which it will ultimately impact the lives of American citizens.